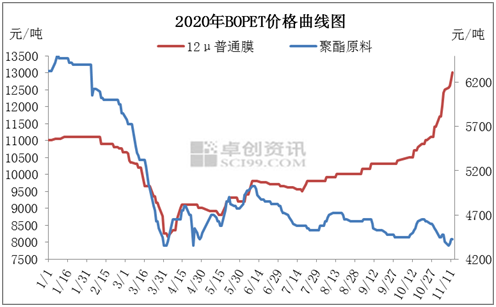

The BOPET market has achieved eight consecutive months of growth from April to November 2020, and the rise in November was even more rapid.

Figure 1 in early April 2020, the price of 12μ film in BOPET market in East China dropped to the lowest level of RMB 7,810 / ton, and rose to the current high of RMB 13,310 / ton on November 13, with an increase of RMB 5,500 / ton, an increase of 70.42%.

12μ film price increase in November, the price at 11510-11810 yuan/ton in the beginning of the month. the current price of 1500 yuan/ton compared to the beginning of the month, up 12.86%.As of November 13, the price of other kinds of products, the price of 12μ film is near 12010-12510 yuan/ton, the price of 6μ film references 17500-18500 yuan/ton in the North China, off base material quoted 12500-13500 yuan/ton, bronzed-film quoted 13500-14,000 yuan/ton, tobacco packet transfer film quoted 14000 yuan/ton.

Spot shortage, retail market 12μ film quotation in 14000-15000 yuan/ton range.

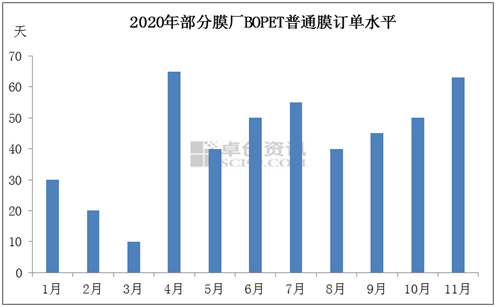

Figure 2 of this wave of rising prices, the direct reason is the enterprise accumulated order is more, the most time of the order is over 40 days. The spot market in short supply, and the root cause is BOPET market in 2020 is expected to begin production enterprises are delayed, and put into production line production of thick film, the thickness of the 12μ and no new production, but every field needs basic is concentrated, mismatch between supply and demand of BOPET market demand, market is hard to find a goods, the prices keep rising.

Demand release depends on a large part of the downstream bottom expected late and bullish expectations in April, each ordinary film enterprise ordinary packaging and printing film order follow up near 20000 tons at the short time. The production ability of the film factory production line only in article / 70 tons/day, 12μ film production line is expected for a long time in near 30, daily output near 2100 tons, in the short term can not complete delivery, order accumulation;Subsequently, the order support film price rebounded, downstream continued to place orders to take goods, film factory orders continued to increase;In addition, due to the longer delivery period, some downstream products are prepared 30 days in advance, which increases the production pressure of the film factory again.

From the end of the first quarter, domestic public health incidents were properly controlled, downstream production was gradually resumed, and the market was gradually restored.However, overseas public health incidents suddenly broke out, and the number of new cases has been on the rise, which affected the normal production of enterprises. Some orders of overseas products were transferred to China, especially for downstream reprocessed products.

In the second quarter, serious public health events, overseas demand for protective mask with membrane increase (from some other new demand, product yield), July suddenly emerged from the type of protective film demand, domestic and foreign orders are good, to a certain extent crowding out ordinary film production, textile product India order back in October, loom start load rate rise to 90% above, bronzing film demand concentration, coupled with a “double 11″, “double 12”, Christmas, New Year’s day and other holidays and electrical business section, have substantial demand for packaging and printing film, so the demand side has been late in the second quarter of the whole performance is relatively strong.

BOPET enterprise order basic above 60 days at present stage, the individual companies to the first order, the spot market is hard to find a cargo, cargo price high phenomenon will still last, short-term market no downside risk, but the raw material price of membrane and toll fee has widened to 9000 yuan/ton, film factory common membrane single tons gross margin in the vicinity of 7000 yuan/ton, if prices continue to rise, the downstream’s ability to accept high prices remains unclear.

BOPET market order support is not down risk, still may rise. However, the transaction will gradually reduce, suggest customers book the raw material according to their own consumption, to guard against the risk of high spread.

Post time: Nov-26-2020